The year is almost over but you haven’t quite got around to achieving your money goals for 2021. No problem – you still have the next couple of months to think about what you’d like to achieve in 2022 and then set up a new plan to see those targets through. (Think of it as an early New Year’s financial resolution).

Personal wealth manager Victor Tang tells you how to prepare a budget, grow your income, make prudent investments, and adopt smarter spending and saving habits – so when January comes around you’ll be better positioned to start crushing those goals.

Q: What are financial goals? Can you share some examples of short-term and long-term financial goals?

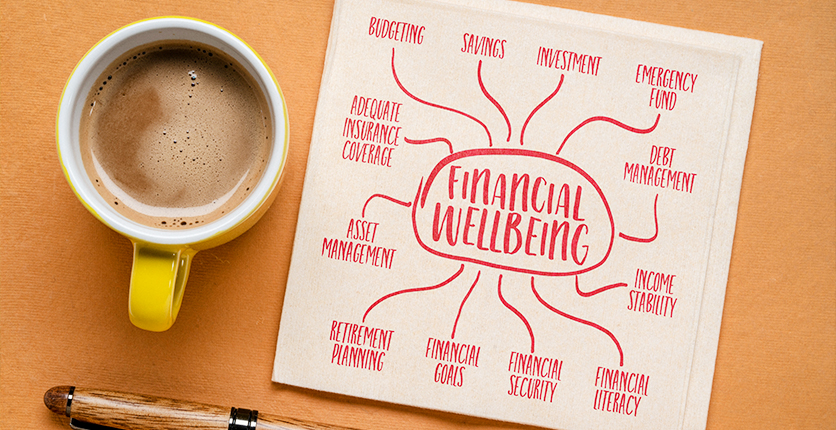

Victor: Financial goals are what help you get to your desired future financial position. You may set them to either help you get out of your current position or achieve more financially. A short-term goal might be to get out of debt, to save for an emergency fund, to purchase an item you’ve always wanted, to travel, and so on. A long-term goal might include creating a retirement fund, having an education fund for your kids, starting a fund for a new business, and setting up an investment fund.

Q: How can setting financial goals help us gain better control of our money?

Victor: Think of these goals as your roadmap to achieving financial freedom. The last 20 months have not been easy for many people. Some have lost their jobs and had to fall back on their savings, while others haven’t been able to make progress with their savings goals because their financial situation has been unstable. Setting goals will help you take purposeful steps towards achieving financial peace of mind.

Q: How do we go about creating our 2022 financial goals and budget?

Victor: Budgeting keeps you grounded in the financial sense. Without a budget, you may end up digging yourself into a hole without even noticing.

Rather than feel intimidated about setting financial goals and budgeting, think of these tasks as fun. When you have a clear idea of your goals, you’ll find it easier to decide what to spend your money on and how much to save. Don’t be afraid to set high targets and to dream big. The best way to set these goals is to write them down with a plan for how to achieve them, and have them handy so that you can look at them every day. As you accomplish each goal, set a new one.

Q: How can we make our financial goals achievable?

Victor: There are many budgeting apps to choose from – download one you’re comfortable using to help you plan a budget. You may also want to adopt an investment strategy, like dollar cost averaging. If you have a financial advisor, review your regular and lump sum investments annually with him or her. Be sure to factor in the investment time horizon and to calculate the expected rate of returns.

Take the time to learn about investing. Familiarise yourself with various terms, such as “rate of returns” and “compounding effect”, as well as risk and reward strategies. Understand the difference between returns and yield, and risk versus volatility.

Don’t delay saving money. The sooner you get into the habit the easier it’ll be to achieve your long-term goals. If one of your long-term financial goals is to have enough money to retire comfortably in 30 years, start saving now.

Q: What’s the best way to grow wealth in 2022 and beyond with minimal risk?

Victor: Bonds generally are a lower risk compared to stocks. You may want to start with a fund that has an actively managed portfolio. There are existing investments in the market that will allow you to follow what rich investors do to accumulate wealth. You may also want to get institutional investors with expertise to manage your funds and make sure your investment performs.

Q: How else can we boost our income in 2022?

Victor: It may not be a bad idea to take on a part-time job if your schedule allows it. Purchasing an investment property is another way to earn some income on the side, but this might be more suited to someone who is middle-aged and has the capital for a second property as opposed to a young working adult. Bear in mind that present yields are between 2.5 and 3 per cent. The average rental yield has fallen from 5 to 3 per cent in the last decade.