If you’re worried about what the future may bring, here’s some expert help. We speak to Eugene Seah, Mindset Speaker and Abundance Life Coach, on how to create financial stability for you and your loved ones in the tough times ahead. Eugene will be one of the speakers at the SAFRA Engagement Forum 2021: Living in an Endemic Singapore. Don’t forget to log on to get more helpful information and advice.

Q: How do you think the endemic scenario will affect Singaporeans and their financial situation and livelihoods?

Eugene: Before the pandemic and endemic, the world was already facing significant changes in the form of AI, robotics, automation and digital transformation. Covid-19 merely expedited the process.

Some Singaporeans have already started improving their digital literacy before Covid, and they were prepared for the changes during the pandemic. Other Singaporeans were not as well prepared, but they were able to adapt and pivot quickly to the new way of working. The rest, unfortunately, are severely affected and struggle to find a job in this endemic scenario.

Q: With the economy and job situation undergoing quick and unforeseen changes all the time, how can Singaporeans (individually and as a family unit) prepare themselves adequately?

Eugene: In 2014 even though the economy was fine, I was personally undergoing stressful changes as I had lost my job and couldn’t find another even after nine months of searching.

I believe the lesson I learnt then is still useful for people facing the same predicament now. We can prepare for the ongoing disruptions and future uncertainties in an endemic situation now. These are the three areas of improvement I consciously made to move into a new career path and embrace a new world:

1) Mindset

Instead of believing that we are controlled by circumstances, we should start believing that we have the power to influence our future. Only by changing our beliefs and mindset can we take constructive actions.

2) Mastery

We all need to learn new skills to prepare ourselves for the new economy. Other than the obvious technology-related skills, we also need to improve our people-related skills (eg. influence, communication, negotiation, etc.) so that we can move into new jobs that require such people skills.

3) Money

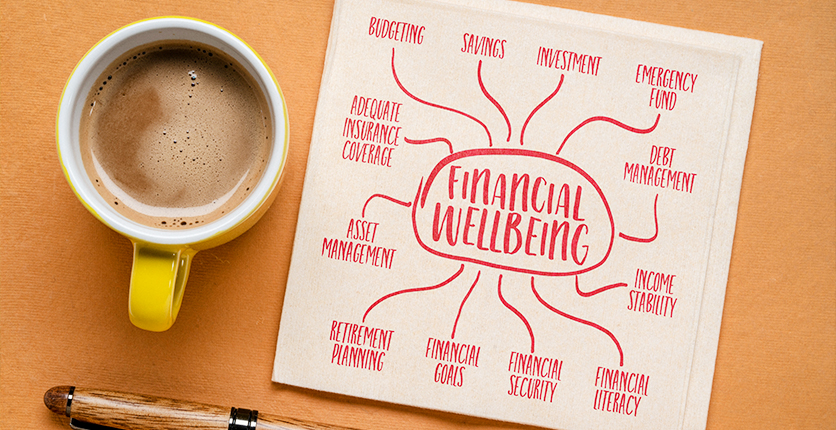

In this uncertain environment, we all need to learn how to better manage our cashflow, income streams and investments. We should avoid excuses like “I don’t know how” or “I’m not interested to learn”.

Q: Is there an urgent need to relook our present lifestyles and adopt changes to improve one’s financial situation?

Eugene: We need to reflect daily to reduce our “blindspots” and increase our good habits. One area that requires urgent change is the way we spend money.

As a financial advisor and life coach, I keep meeting people who tell me that they are financially in a bad place, but yet continue to buy overpriced food products like bubble tea, Starbucks and unnecessary snacks! In the past when I was unemployed and broke, I ate two plates of “cai png” (economy rice) everyday, spending no more than $5 per day on my food. I sold my car and took public transport everywhere.

Those cost-cutting measures helped me to survive the lean periods. I still meet a lot of people now who are unwilling to make these “sacrifices” and continue to overspend, which will lead to unstable finances.

Q: What other areas can we change and look into to improve our finances?

Eugene: Besides just spending less, we need to learn how to earn more and grow our money safely. I keep meeting people who fall into scams, or had their money trapped in stocks that don’t perform well. I now invest my time to help others learn safer ways to invest, instead of taking on too much risk. I also coach my clients on negotiation skills so that they can earn more in their jobs or business.

Q: How can family help in these situations?

Eugene: Family members can support by saying encouraging things to those who are going through a tough time. Unfortunately, I’ve often observed that many individuals don’t appreciate the efforts of their family and loved ones, often pouring cold water on their family members’ suggestions and ideas.

I remember when I first wanted to start a business combining life coaching with financial consulting, many people told me it wouldn’t work and that it would fail for sure. Thankfully I didn’t listen to them, and now I can provide for my family abundantly, while helping others do the same.

The SAFRA Engagement Forum is a Facebook Live Event which will focus on Financial Sustainability, Mental Wellness and Food Sustainability.

This free event happens on:

Date: Thursday, 7 October 2021

Time: 8pm – 9.30pm

Log on to www.facebook.com/SAFRAsg to view it LIVE

For more info on the forum, go to www.safra.sg/whats-on/engagementforum. If you have any questions for our speakers or other queries, please email sync@safra.sg