Starting a new job as a young adult can feel pretty exciting. You get to work with different people and learn new things, and for the first time in your life, you may be earning more money than you ever have.

It can be tempting to want to spend your pay cheque on clothes, holidays and social activities. And while it’s perfectly fine to treat yourself, it’s also important to be smart with your money so that you can set yourself up for a more financially stable tomorrow.

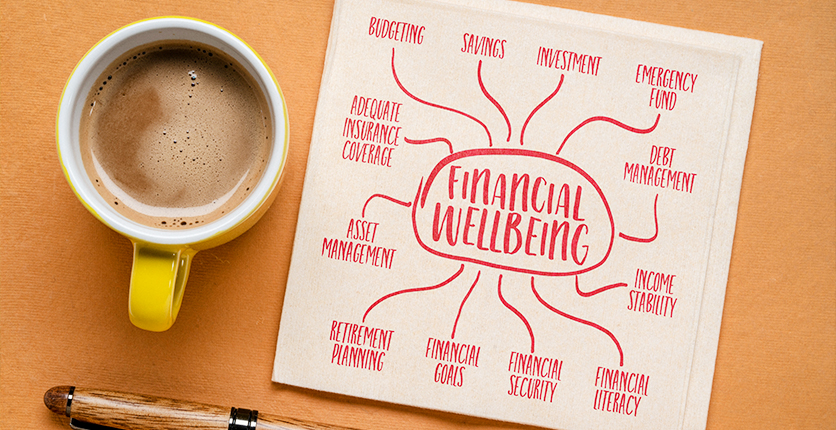

Here, we share eight tips to grow your nest egg, plan for a wealthier future, and spend your money wisely.

1. Plan your financial future

The financial habits you form in your 20s tend to stick with you as you get older, so ask yourself where you want to end up, 20 or 30 years from now with regard to your money situation, says Andrea Kennedy, a certified financial planner and finance behaviour specialist at Wiser Wealth. Do you want to feel financially secure and in control of your money, or do you want to be drowning in debt? Old habits die hard, so decide from now what habits you want to cultivate.

Life is also unpredictable, so don’t assume that things will always be as they are now. Plan both for opportunity and the unexpected, she adds.

Andrea’s next tip is to decide who influences your money decisions. Are you listening to people who have your best interests at heart and can guide you in the right direction, or to people who are going to send you down a rabbit hole of poor financial choices and self-defeat?

Finally, she says that while growing your CPF funds is a good starting point for securing your financial future, it’s not enough. She advises you to decide how much you want to save for retirement and to start investing early to boost your CPF savings.

2. Forget budgeting, just be a smart saver

It’s good to save money but even better to invest those savings. If you still live at home, you are likely to have fewer financial responsibilities and can therefore afford to put more money aside every month.

“If you earn, say, $5,000, and $1,000 of that goes to your CPF account, save and invest 20 to 30 per cent of the remaining amount from the get-go,” Andrea explains.

Think of this as paying yourself first. If you have bigger financial goals, you can always save more.

“That leaves you with some spending money and money to help your family, and forces you to decide how to best use the balance,” Andrea continues.

“It’s a type of forced savings exercise that makes you confront your spending. This is far more effective than budgeting.”

3. Don’t wait to save and invest; start now

Saving in and of itself does not keep your money on pace with inflation, which is why it makes more sense to invest your money, says Andrea.

Even if you earn an average income, if you start investing from a young age you’ll have more time to grow your wealth and be well on the way to becoming a high net-worth individual when you’re older.

“Starting early also means that if you lose your job or your income takes a hit, you may be able to get through a year or two of unemployment without it affecting your retirement,” Andrea adds.

Find out more about the fundamentals of investing – how, when and what to start with on your investment journey.

4. Create an emergency fund

You never know when you may need to come up with a substantial amount of money, whether for a health or family crisis or some other type of emergency. Rather than dip into your savings, it’s a good idea to set up a separate emergency fund that you can access if the need arises.

Andrea suggests putting aside two months’ worth of expenses if you’re still living at home with your family. Depending on your circumstances you may want to save more. She recommends investing this money in term deposits.

Here’s how to figure out how much you should have in your emergency fund.

5. Buy quality over quantity

Whether it’s clothing, accessories, gadgets or home appliances, high-quality products give you more bang for your buck because they last longer – this means you’re less likely to have to replace them every few months or years, thereby saving more money in the long run. Buying high-quality items needn’t always translate to buying designer brands or even spending a lot of money; it just means choosing products that are timeless and well-made and that you know you’ll use for years to come, rather than a cheaper version that will fall apart or go out of style after a short time.

6. Take advantage of discounts and deals

As a SAFRA member, you’re entitled to a range of discounts and deals on everything from holidays, cruises and accommodation, to food and beverages, movie tickets, clothes and footwear, gifts, spa treatments, gym memberships, music lessons and more. Find out more about signing for SAFRA membership here, and for current promotions, check out safra.sg/promotions.

7. Join loyalty/reward programmes

Loyalty or reward programmes help members save money by way of discounts, cash back, member or VIP perks, redeemable points, free shipping, free returns and so on. Take some time to research those programmes that you feel you’ll get the most out of – usually from brands and companies that you tend to spend the most money with or shop at the most often. Think airlines, department stores, specialty stores, supermarkets, pharmacies, bookstores, hotels and restaurants, for example.

Loyalty or reward programmes help members save money by way of discounts, cash back, member or VIP perks, redeemable points, free shipping, free returns and so on. Take some time to research those programmes that you feel you’ll get the most out of – usually from brands and companies that you tend to spend the most money with or shop at the most often. Think airlines, department stores, specialty stores, supermarkets, pharmacies, bookstores, hotels and restaurants, for example.

Learn how to maximise your savings with these shopping hacks.

8. Timing matters

Planning a holiday? Take advantage of cheaper airline fares and hotel accommodation during the low travel season (typically outside of school and festive holidays). You can also get discounts to attractions and places of interest during off-peak hours. And shopping at local markets and street shops in the early mornings or late evenings can give you better deals, as vendors are more open to negotiation when there are fewer customers around.

Check out our tips to save money on holiday planning.

Want more articles like this, and other lifestyle content right in your inbox? Download the new SAFRA mobile app and opt in for the eNSman Newsletter – you don’t need to be a SAFRA member to subscribe – and never miss another story!