There is never a perfect time to start saving, protecting, and investing for your future and that of your family’s. Whether you have just received your first paycheque or are in a mid-career stride, it is never too late nor too early to start building your nest egg.

With a one-stop solution like Singlife’s app, you’ll be streamlining and helping your money work harder with just a few taps. This will put you steps ahead in your journey to build a comfortable rainy-day fund.

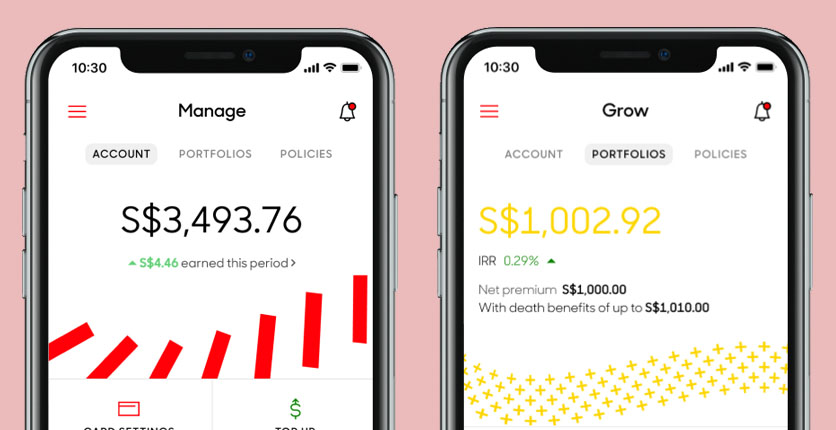

In today’s low interest rate environment, Singlife’s flagship mobile product – the Singlife Account – lets you save and earn up to 2.0% p.a.* return. This insurance savings plan also covers you against unfortunate events such as death or retrenchment. The convenience of signing up for a policy plan in a few taps, means you save on the time having to meet a financial planner or trying to understand endless pages of fine print. All you need is really at your fingertips.

Investing With Might

Investing your money is like making it run a marathon, working hard for you over the long-term. The earlier you start, the more time you have to steadily work towards your financial goals.

We understand that everyone has different life goals, situations, and risk appetites, which change as we enter different life stages. That’s why Singlife introduced Singlife Sure Invest, an investment-linked policy, which allows you to choose between 3 different risk rated portfolios to suit your risk appetite. Based on your comfort level, you can choose from either Conservative (low-risk), Balanced (medium-risk) or Dynamic (high-risk) portfolio. You also have the option to switch to a different portfolio as you go through different life stages, or when you have a change in your financial situation, such as when you change jobs, which might impact your risk appetite.

Let’s take Jane as an example. As a first-jobber, she chooses a Conservative portfolio to kickstart her investment journey. Five years later and after an increase in her base pay, she decides to switch to a Dynamic portfolio, as she wants to save for retirement to be able to stop working when she is 50. With higher expected returns in the Dynamic portfolio, it may help her reach her goal sooner! All you need is S$1,000 to start. These portfolios are managed by professional portfolio managers at Aberdeen Standard Investments for a quarterly management fee of 0.25%. Curious about how Singlife Sure Invest has been performing? In the past year alone, the Dynamic portfolio has achieved a 17.79% return1.

Singlife Sure Invest allows you to eliminate the daunting complexity of keeping yourself up to date with daily market movements, predicting where the markets will head, and anything else that might impact your investments. Leave these in the hands of professionals so you can spend your time on what matters most.

Strategise With Stealth

To transform your savings into an even more powerful ROI machine, vet your monthly expenditures. Do you have multiple subscriptions such as media streaming and app services that can be consolidated? Can you sell off clutter (such as clothes, bags, old appliances) you no longer need? Funnelling these unlocked funds into the Singlife Account or investing them into a Singlife Sure Invest portfolio can yield you even more returns! What’s more? Consolidate all your spending with a Singlife Visa debit card and you can monitor your expenses closely on the Singlife App. By doing this, you can keep an eye on your expenses and make the most of your hard-earned money in the Singlife Account.

Simply keep your Singlife Sure Invest policy active and spend at least S$500 with the Singlife Visa debit card within a policy month to enjoy an additional 1% p.a. return on top of the base return of 1% p.a. on your first S$10,000 in your Singlife Account. That makes it 2% p.a. on your first S$10,000. Isn’t that a better deal than having an additional media streaming account or buying an extra pair of sneakers?

Save now and your future self will thank you. Name the Singlife Sure Invest portfolio after your goals e.g. for Jane, it’s “Big 50 freedom”. You can even start a recurring savings plan with as little as S$100/month to help you achieve your goals sooner. If you suddenly need money at any point in time, you can withdraw from both the Singlife Account and your Singlife Sure Invest portfolios with no lock-in and penalties at all!

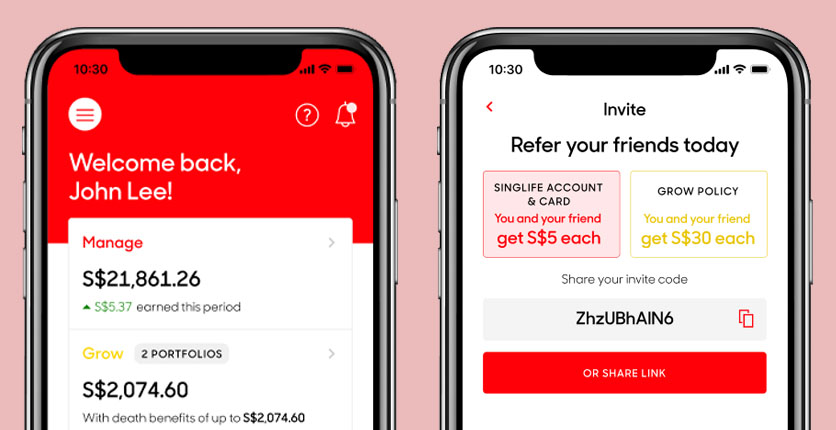

To sweeten the deal, Singlife is currently running a referral campaign. You and your friends earn S$5 each when they sign up for a Singlife Account and Card using your unique referral code. Plus, you each earn an additional S$30 when your friend signs up for a Singlife Sure Invest policy after their Singlife Account is in force! Why wait? Ask around for a referral code and register for your own Singlife Account to start referring your friends & family!

Kickstart your savings and investing journey with Singlife today. Click here to find out more about the referral campaign and the Singlife Account.

This post was brought to you by Singlife.