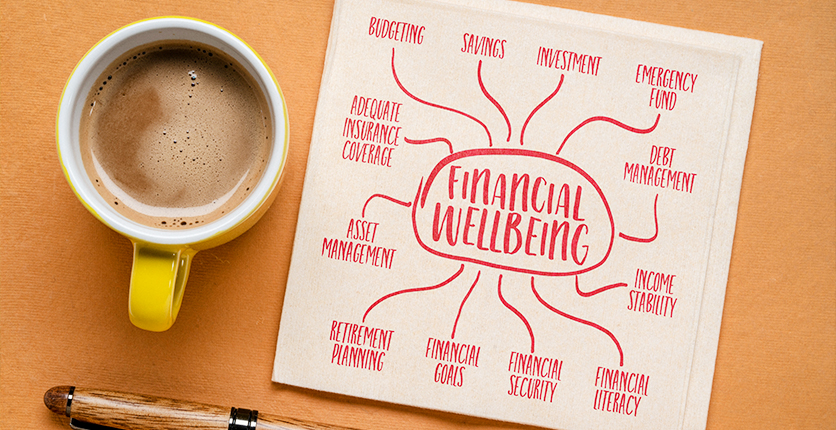

Are you still making resolutions to grow your money or enhance your financial situation in 2025? It’s not just about saving more and spending less. Sure, these are important for having extra money to spend on personal and family pursuits and to avoid falling into debt, but they’re not always enough if you’re looking to improve your overall financial well-being in the long run.

From setting clear financial goals to creating an emergency fund, here are eight expert tips to help you get on the road to financial stability and freedom.

1. Understand what it means to be financially “fit”

According to Ow Tai Zhi, the co-founder and chief investment officer for robo-advisory platform AutoWealth, being financially fit means having adequate money set aside for unforeseen emergencies, catering adequately for your family’s insurance and protection needs, and not being indebted to anyone. When you are financially fit, you’re in a better position to build wealth over the long term and gain financial independence.

2. Define your financial goals

“It’s good to have resolutions, but resolutions can become unachievable, too boring or too uninspiring after a while,” says Tai Zhi.

Instead, set well-defined financial goals. They should be easy to follow so that you don’t give up on them. Here, Tai Zhi shares a few pointers for creating these goals:

- The goal should be quantifiable and have a clear timeline – for example, setting aside or adding a certain amount of money to your investment portfolio by the end of the year.

- The goal should be inspiring or contribute towards something inspiring, like adding to your investment portfolio so that you can be financially independent at 50 years old.

“And who doesn’t want to be financially independent and enjoy life at 50?” Tai Zhi asks.

- Beyond good goal-setting, tracking your progress at regular intervals is equally important. Tracking not only helps you to celebrate interim milestones, it also keeps you accountable and enables adjustments so that you don’t fall short.

3. Open an emergency fund for unforeseen expenses

“An emergency fund not only prepares you for unforeseen situations; it also doubles as a war chest to help you capitalise on market discounts from time to time to enhance investment returns,” Tai Zhi explains.

“It’s good to set aside an amount equivalent to six months’ of expenditures. These funds will keep you afloat during an emergency, such as if you fall ill and have to stop working for a while.”

Here’s how to plan ahead and protect your family’s assets and wealth.

4. Manage financial stress

Financial stress is real for many people, especially with the rising cost of living. Tai Zhi says that awareness is the first step to overcoming this stress.

“Identifying the source of your financial stress allows you to create a plan to address your concerns. So, organise and take stock of your finances and make a list of the financial struggles that concern you the most,” he advises.

“Tackle each financial problem slowly, one at a time. You may need to find additional sources of income and defer non-urgent, non-critical discretionary spending.

“Along the way, do not neglect your health. This means following a healthy diet, getting adequate sleep and exercising regularly to help you manage your stress.

“Setting aside an emergency fund can also help ease your stress about unforeseen expenses. And consider purchasing insurance to protect yourself and your loved ones against unexpected emergencies. These financial safety nets will give you a sense of security and peace-of-mind.”

5. Differentiate between wants and needs

Knowing what you want and what you need makes it easier to stick to your financial goals.

Tai Zhi says that needs are things you can’t do without – like housing, for instance – whereas wants are those you can get by without, like staying in a condo with a pool.

A good budgeting framework is the 50/30/20 rule: Setting aside 50% of your income for needs, 30% for wants and the remaining 20% for savings and investments.

“If you want to achieve financial independence and retire early, you should adjust this ratio by cutting down on your wants and increasing your savings and investments,” Tai Zhi adds.

Can’t seem to save? Find out about the 8 bad money habits that could be hurting you financially.

6. Understand the risks involved in investing

No financial product can be 100% profitable all of the time.

Tai Zhi says that you should only make an informed investment decision after you fully understand the investment product and the risks associated with it.

“This will help you manage your expectations and ensure that the risks are tolerable to you. The last thing you want is to panic and cut your losses when an eventual rebound is right around the corner.”

7. Protect yourself with insurance

“Insurance is useful to protect against unforeseen emergencies,” says Tai Zhi.

“Having this financial safety net provides a sense of security and peace of mind, not only for you but also your loved ones.”

8. Be a savvy saver, but remember to enjoy your journey to financial fitness

When it comes to saving money, it’s important to be consistent and disciplined. Tai Zhi advises you to save at least a dollar for every dollar you spend. You should also be focused – before making any purchases, set a clear spending limit to avoid going over your budget.

You may also wish to find good alternatives to growing your savings. Tai Zhi says that cash management solutions like AutoWealth Flexi Cash or money market funds can help you earn an attractive yield of more than 3% per annum.

Of course, becoming financially fit shouldn’t leave you feeling like you have to wait until retirement to enjoy your money.

“I recommend celebrating interim milestones along your journey to motivate yourself to keep going,” Tai Zhi explains.

“For example, take your family out for a fancy dinner to celebrate your investment gains made in 2024. Also consider exciting challenges, such as not spending a cent on payday or drinking only water instead of buying soft drinks or bubble tea, which can add up to quite a bit over the week.”

Want more articles like this, and other lifestyle content right in your inbox? Download the new SAFRA mobile app and opt in for the eNSman Newsletter – you don’t need to be a SAFRA member to subscribe – and never miss another story!