Total Defence involves every Singaporean playing a part, individually and collectively, to build a strong, secure and cohesive nation – because when we are strong, we are able to deal with any crisis.

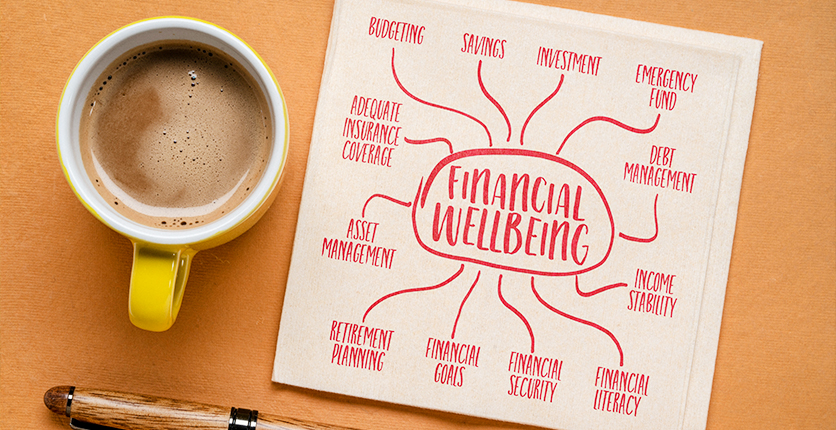

There are six “pillars” of Total Defence, one of which is Economic Defence. This pillar is about strengthening the competitiveness and attractiveness of our economy, ensuring that it not only continues to be successful but also stays resilient, so that it can recover quickly should we face economic uncertainty in the future (such as if there is a global downturn or economic crisis that could shake investor confidence in Singapore).

There are many ways to put Economic Defence into action, and we can start at home – because when Singaporean families are financially strong and resilient, we help bolster the country’s economic strength and resilience, too.

Here are six ideas to protect your family’s wealth and help your loved ones survive any financial storm.

1. Save and invest wisely

We all know that saving more and spending less can help us manage our finances and contribute to wealth-building. Ow Tai Zhi, the co-founder and chief investment officer for AutoWealth, recommends being disciplined about these habits.

“Keep a close eye on your spending and always set a clear spending limit. A good budgeting framework is the 50/30/20 rule – allocate 50% of your income to needs, 30% to wants, and the last 20% to savings and investments. ‘Needs’ are things that you cannot do without, like housing, whereas ‘wants’ are those you can get by without, such as staying in a condo with a pool. If you want to achieve financial independence and retire early, you should adjust this ratio and aim to save one dollar for every dollar you spend.”

You should also keep investing throughout your life and not just stop once your investment has matured, he adds.

“There are people who will invest and stop investing, and others who’ll invest and keep investing. Saving and investing regularly is a disciplined way of building wealth over the long term by eliminating the hassle and emotional fear of trying to time the market. It helps to smooth out market fluctuations by averaging out your cost of investment, leading to better returns.”

New to investing? Here’s what you need to know.

2. Set aside money for a rainy day

You can’t always guarantee that you’ll be able to provide for your family. That’s why it’s important to protect your family’s finances as early as you can, especially if you’re the main or sole breadwinner.

For those “rainy days”, for instance, Tai Zhi recommends starting an emergency fund. Stashing away a substantial amount of money can safeguard your family against unforeseen situations – such as if you get injured and can no longer work. It also doubles as a war-chest, allowing you to capitalise on market discounts from time to time to enhance your investment returns.

“It’s a good idea to put aside an amount equivalent to six’ months of expenditures,” he says.

“This will give you enough time to come up with alternative ways to earn extra money and also serve as a buffer in unforeseen situations, like if you fall ill for a prolonged period or find yourself unemployed for some time.”

3. Create a will

Always prepare for the unexpected, Tai Zhi notes. Establishing legal arrangements, such as a will, Advance Medical Directive (AMD), and Lasting Power of Attorney (LPA), will ensure that your estate is distributed according to your wishes and that your loved ones will be looked after.

Don’t delay putting your will together. Wills aren’t just for older people who are close to retirement. You can create one even if you’re just starting out in your career.

“Establish a will as early as possible and make it as clear, elaborate and practical as possible, particularly if you have dependents like young or vulnerable children or elderly parents, or if you’re your family’s sole breadwinner,” Tai Zhi advises.

Find out more about making a will and legacy planning here.

4. Pay off your debts

Accruing debts can affect your ability to become financially independent and retire early, says Tai Zhi.

“In June 2013, the Monetary Authority of Singapore introduced a Total Debt Servicing Ratio (TDSR) to limit loans granted by financial institutions to 60% of an individual’s monthly income. This measure, which was later revised to a more stringent 55%, aims to encourage financial prudence.”

But Tai Zhi recommends taking an even more prudent approach towards incurring and paying off debts.

“The first material loan you incur should always be a mortgage loan to provide a roof over your head. This is a need. When your financial situation permits, you can then take up a loan for your wants, be it a fancy home renovation or that flashy car you’ve had your eye on. Then, adapt the 50/30/20 budgeting rule – limit your debt payments to within 50% of your income, keep needs and wants within the 30% threshold, and strive to keep to the 20% savings and investment goal.”

Tai Zhi advises against taking out a credit card loan as it’s not prudent and bears very high interest rates.

5. Invest in an insurance plan

Nothing is certain in life – severe illness, disability, job loss, and loss of life can occur at any time. A good insurance plan gives you peace of mind that your family will be financially secure should something happen to you and you can no longer look after them. It will also safeguard your family’s finances, so that your loved ones won’t have to dip into your savings to get through the tough times.

There are several types of insurance available, like health, critical illness, hospitalisation and personal accident, to name a few. It’s a good idea to speak to an insurance specialist to decide what plan or policy works best for you and your family.

6. Teach your kids about money

Children are never too young to develop good financial habits. Encourage your kids to start saving their allowance, teach them the difference between a “want” and a “need”, show them how to budget, discuss ways to earn money, and educate them on the importance of setting financial goals and establishing an emergency fund.

Teaching financial savviness to your little ones gives them the tools, skills and knowledge that they need to be resilient when confronted with economic challenges when they’re older.

Here’s how to teach your kids to be money-smart.

Want more articles like this, and other lifestyle content right in your inbox? Download the new SAFRA mobile app and opt in for the eNSman Newsletter – you don’t need to be a SAFRA member to subscribe – and never miss another story!